How a trailblazing sustainability team drives business innovation

Microsoft's Matt Hellman shares real world examples for sustainability leaders looking to accelerate innovation and achieve big goals.

In today's business landscape, addressing climate change is not just a matter of corporate responsibility; it is a strategic imperative. As governments, investors, consumers, and industry peers increasingly demand sustainable operations, companies must make climate action a core part of their strategy.

The science is clear: decarbonizing the economy is essential to limiting global warming. However, decarbonization alone cannot get us to net zero and must be complemented by carbon dioxide removal (CDR) to address hard to abate emissions. As companies around the world strive to meet sustainability goals, developing a CDR strategy is critical. In the following sections of this article, we explain how delaying action poses significant risks for companies, while investing in CDR now has a positive business case and is critical to preventing irreversible climate impacts.

Driven by the momentum of sustainability commitments, demand for CDR is expected to soar in the coming years, far outstripping supply capacity. Projections show that by 2030, demand for carbon dioxide removal will exceed supply by about 1 gigaton, equivalent to 2% of annual global CO₂ emissions, leaving more than 70% of demand unmet. Scaling the CDR industry requires considerable time and financial resources to achieve widespread adoption. Innovation is critical to reducing costs and delivering high quality CDR at scale, and the time required for technological advancement limits supply.

Despite limited supply, demand is expected to grow rapidly, driven by an exponential increase in the number of companies committing to net zero targets as part of the Science Based Targets initiative (SBTi), nearly doubling each year from about 1,000 in 2020 to about 8,000 in 2023. At the end of 2022, these companies represented 34% of global market capitalization and included 38% of all Fortune Global 500 companies. To effectively meet their net zero commitments, companies must go beyond emission reduction efforts and invest in CDR technologies to remove the remaining emissions that are not technologically or economically feasible to reduce. This requires the implementation of large-scale, long-term CDR scaling strategies, creating a growing supply-demand imbalance. Bridging this gap will be a global challenge and underscores the need for companies to secure access to CDR volumes today.

Delaying action poses significant risks on several fronts. For example, missing sustainability targets due to CDR shortages can cause reputational damage and undermine stakeholder confidence, impacting metrics such as earnings per share (EPS) and shareholder value. In addition, regulatory frameworks are increasingly requiring carbon neutrality claims to be backed by scientific validation or third-party verification, exposing companies to litigation and penalties for non-compliance on climate credits. In fact, claims relying on avoidance offsets and those not in line with climate science may soon be banned and fined by the EU, pushing companies to move away from avoidance and toward high quality CDR.

The CDR market is poised for significant disruption, with prices expected to pick up very soon as competition for supply intensifies. Organizations must recognize the urgency of the situation and take advantage of the current window of opportunity to lock in favorable pricing. By entering into long-term CDR contracts now, companies can protect themselves from financial volatility and price spikes expected after 2024.

By investing in CDR today, companies benefit from a positive business case and a significant return on investment. As consumers, investors, and employees increasingly value sustainability and demand environmental responsibility from companies, acting on climate is critical to meeting evolving stakeholder expectations and early movers can gain a competitive advantage.

For example, companies committed to environmental excellence, particularly those in the top quartile of environmental performers, can access cheaper financing with a potential reduction in the weighted average cost of capital of about 100 basis points, improving overall financial performance and stability. They can also play in higher-growth segments by marketing their products as "green," which have a compound annual growth rate of 4-25 percentage points higher than conventional alternatives. Sustainability leaders also deliver better shareholder returns than laggards, by an average of 3 percentage points over four years. Finally, companies can protect themselves from reputational and compliance risks, as greenwashing can result in a reduction in earnings per share (EPS) and a litigation fine of up to 10% of annual revenue. By demonstrating climate leadership and future-proofing their climate targets in a constrained environment, companies can stay at the forefront of their industry, strengthen their brand, and reduce their risk exposure.

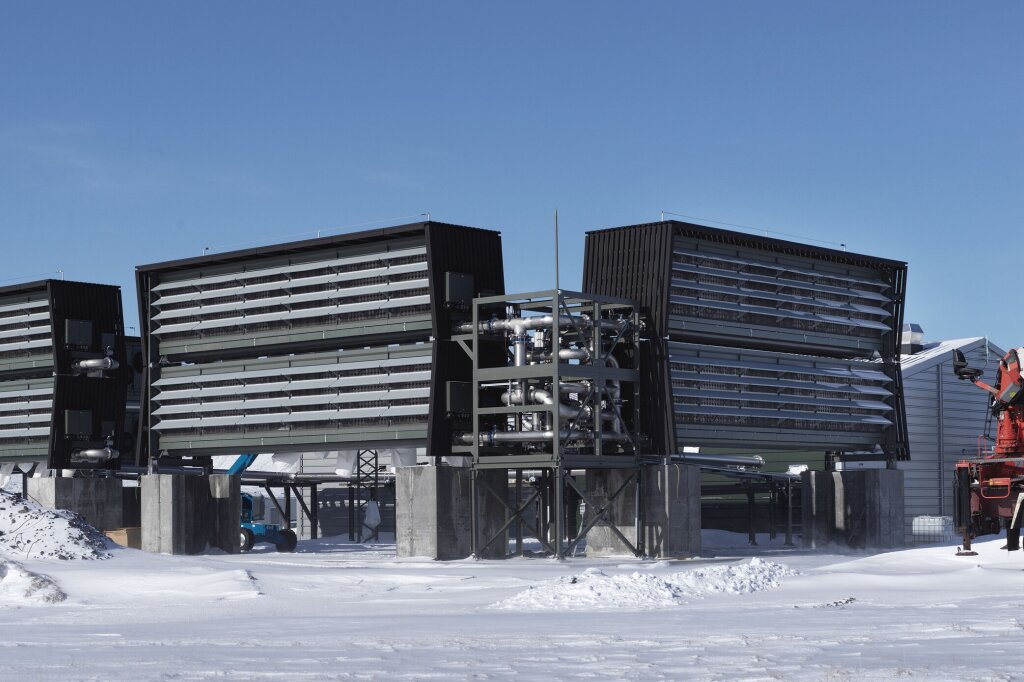

The need for carbon dioxide removal goes beyond immediate business interests: CDR is an essential ingredient in the recipe for keeping global warming below 1.5 degrees. To put the magnitude of the challenge in context, the IPCC estimates that about 10 gigatons (Gt) of CO2e will need to be removed each year by 2050. However, the CDR capacity available today is only a tiny fraction of this need, with novel methods such as DAC+S, biochar, BECCS, or enhanced rock weathering accounting for only 2 million tons of CO2e per year. Closing this gap will require a monumental scaling of the CDR industry by a factor of more than 1000 times to meet the 10 Gt target by 2050. Such a growth trajectory is not unprecedented, mirroring the rapid expansion of the solar and wind industries since the 1990s, which achieved compound annual growth rates of around 20-40%. While this challenge is daunting, it is achievable considering the successes of the renewable energy sector and highlights the urgent need for concerted support from investors, buyers, and policymakers to help the industry scale up.

Delaying action to support the scale-up of CDR technologies and projects increases the risk of crossing critical climate thresholds. Each year of inaction increases removal costs by $100-200 billion for the same CDR target and exacerbates barriers to achieving long-term climate resilience. With global temperatures already at +1.48 degrees Celsius above pre-industrial levels in 2023, many Earth systems could already pass a point of no return in the next one to five years, leading to irreversible and catastrophic consequences. Earth scientists have identified sixteen tipping points, or thresholds of irreversible change in our climate, and five of these are at risk of being crossed with a temperature increase of about 1.5 degrees Celsius. These sixteen tipping points, ranging from the collapse of ice sheets to the destabilization of ocean currents, could trigger cascading effects that amplify the impacts of climate change and threaten global health, security, and societal stability. Given recent trends in daily global surface air temperature anomalies, which have exceeded the +2 degree Celsius threshold twice in recent months, there is an urgent need to minimize climate overshoot now. Sufficient funding for the CDR industry is essential to drive innovation, scale up production, reduce costs, and ultimately ensure a sustainable future.

Companies must act now. Investing in CDR today is not just an option, it is a necessity and an opportunity to secure CDR supply and future-proof against risk, capitalize on a positive business case, and maximize impact on the planet. By making CDR a strategic priority today, companies can position themselves as sustainability leaders and make a meaningful contribution to the global fight against climate change.

Microsoft's Matt Hellman shares real world examples for sustainability leaders looking to accelerate innovation and achieve big goals.

Discover some of the innovative techniques used by carbon removal companies, equipping us for the future with their approaches to carbon dioxide removal.

Reflecting on the development of carbon markets, as well as ways that companies can proactively meet their long-term sustainability targets

No cookies = No worries: We don’t use 3rd party cookies and only use the cookies we strictly need to keep our website functioning. Our website usage data is 100% cookie-less, anonymized, safely stored in Switzerland and under our full control. For more information, please check out our privacy notice.